The Serviced Apartment Price Radar 2019 report published annually by Acomodeo highlights price differences in the world’s major business destinations, when booking a serviced apartment compared to a hotel room in 2019. The key learnings can be summarized as follows:

- For long stay travel (4 nights and longer), booking a serviced apartment over a hotel is more cost effective, regardless of the destination.

- The destination’s relevance for long-stay travel plays a major role in the average price as the longer the stay, the lower the price.

- Serviced apartment supply can strongly differ from region to region and from one city to another, which consequently has an impact on competitiveness.

- South-Western and Central European regions offer the most consistent price advantages, as a result of well stablished long-stay demand and supply.

- Despite the limited living space in global megacities in relation to the vast demand, serviced apartments still outperformed hotels in New York, London and Tokyo to name just a few.

Serviced apartments: a degressive pricing model and more comfort for the long stay traveler

Contrary to hotels, serviced apartments' price per night decreases as the length of stay increases. This digressive pricing model, together with the superior comfort, makes serviced apartments especially attractive for long stay travel.

Eric Jan Krausch, founder and CEO of Acomodeo is positive when addressing the current situation and direction of long stay business travel: "During these 5 years in the market we experienced multiple trend changes for both demand and supply. We transitioned from a market where the long-stay offer was limited and hardly known by the traveler, to a blooming supply and explosion of demand by companies and travelers alike.”

He adds: “In recent times we have observed the ever growing necessity of companies to optimize their budget. By offering a fully online end-to-end long-stay booking solution, we are helping companies save countless of man-hours and travel budget. Acomodeo negotiated rates and digressive prices are simply the icing on the cake".

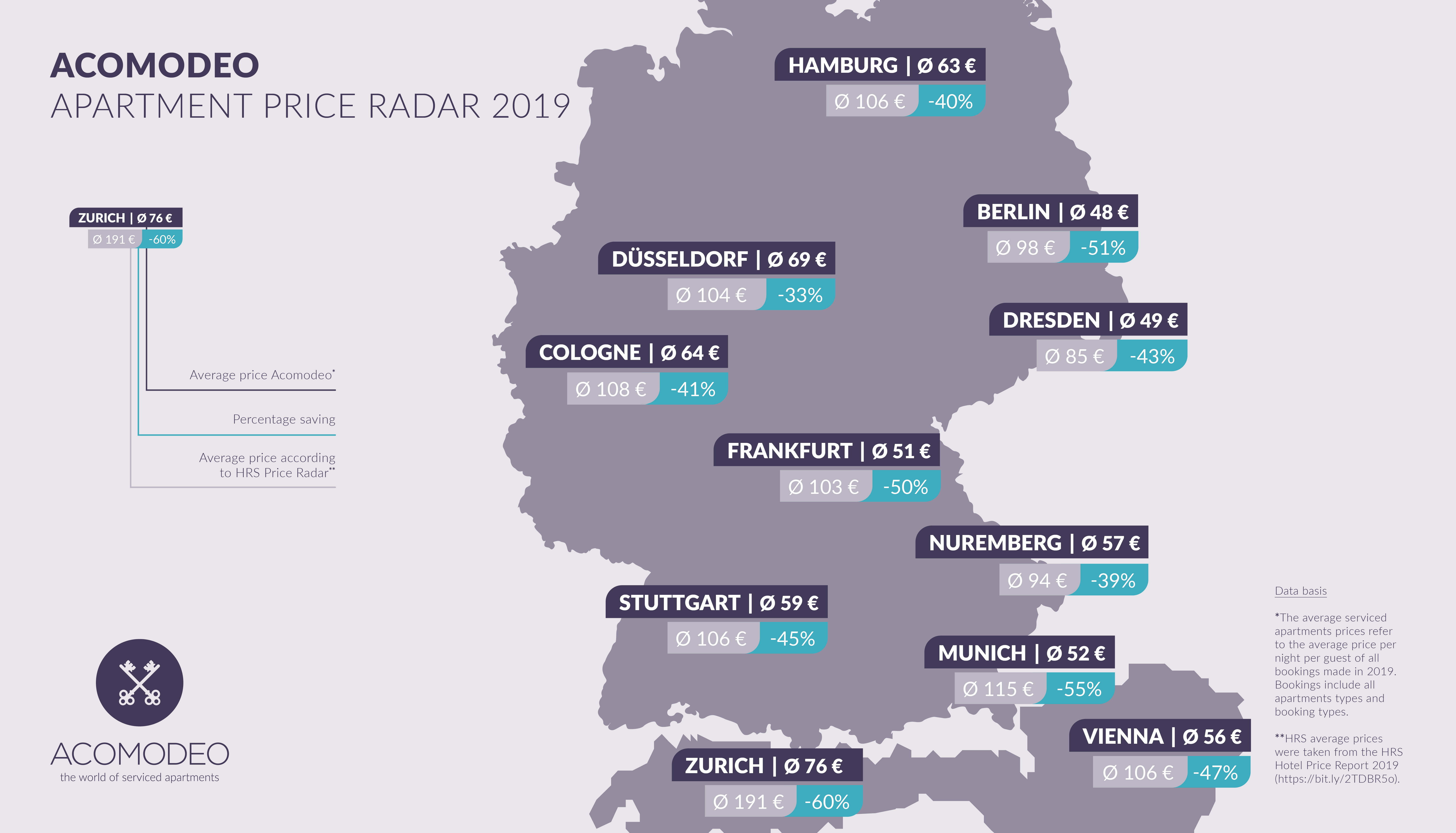

Central Europe

The Central Europe benchmark offers a deep view of the serviced apartment market and its hotel counterpart. Acomodeo’s serviced apartment prices ranged from 48€ to 76€ while the HRS hotel prices ranged from 85€ to 191€. This translates into price differences ranging between -33% and -60% in favour of Acomodeo’s serviced apartments. Zurich represents the highest price gap between the average booked serviced apartment (76€, Acomodeo) and an equivalent hotel room (191€, HRS), setting 2019’s biggest price difference at -60%.

Given the steady expansion of serviced apartment supply, together with the constant demand increase for long stay travel, this progressive trend is expected to continue over the coming years in Central Europe.

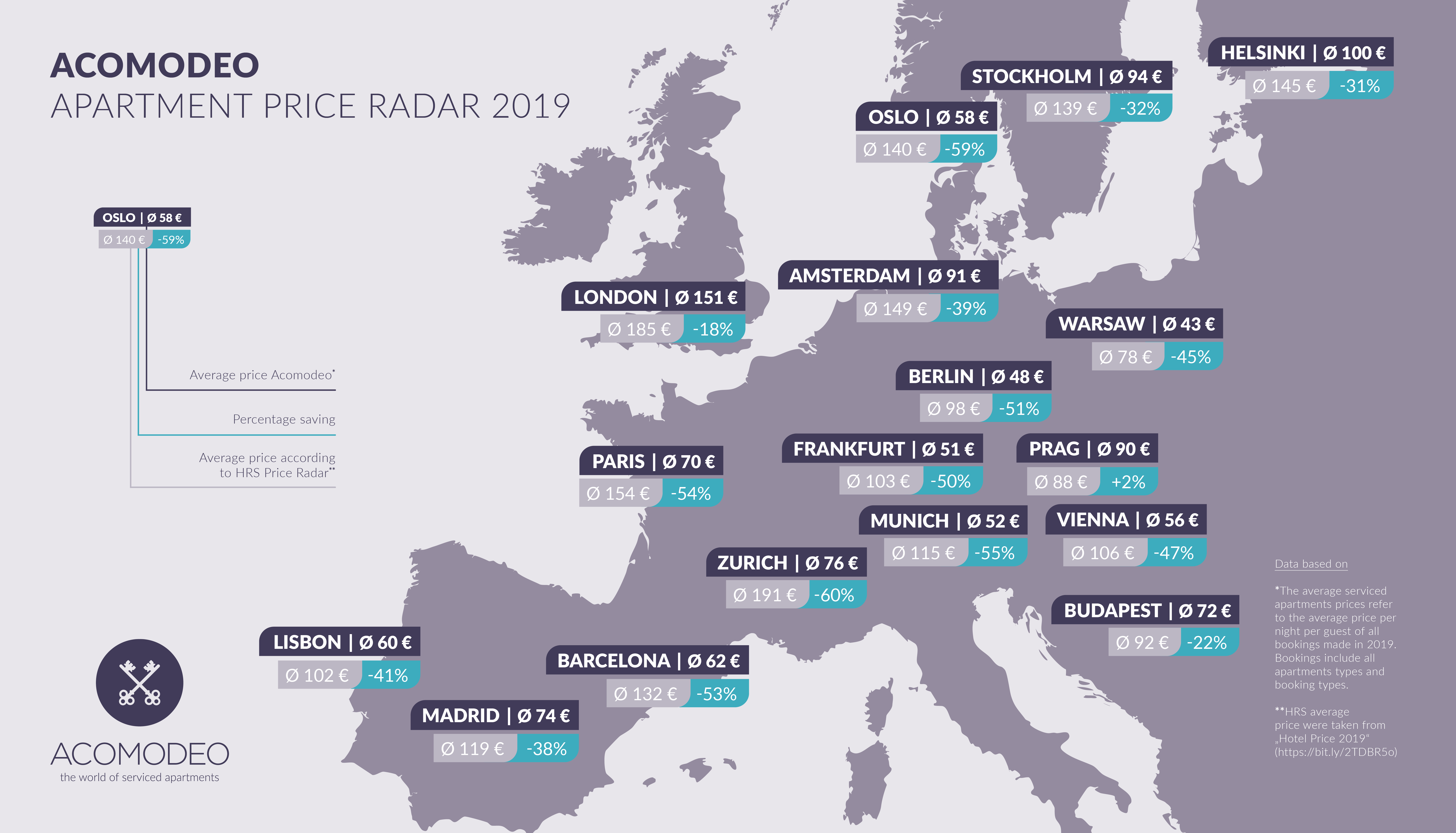

Europe

Europe offers a wide-ranging perspective. Both South-Western and Central European regions showed the biggest consistency in terms of low apartment prices (43€, 76€) and saving potential (-38%, -60%). The rapid expansion of serviced apartment brands in this territory has been a key factor for obtaining such favourable results.

London (151€, -18%) suffers from the same phenomenon as other megacities, meaning that living space in the city is particularly limited when compared to the vast demand. This gap consequentially inflates accommodation prices, leaving serviced apartments little room to be as competitive as they could be, ultimately limiting the potential of serviced apartments.

In contrast Prague tells a different story, with serviced apartment prices (90€) surpassing hotel prices (88€) by +2%. This can be attributed to a particularly competitive hotel market and a relatively low interest in Prague for long-stay business travel.

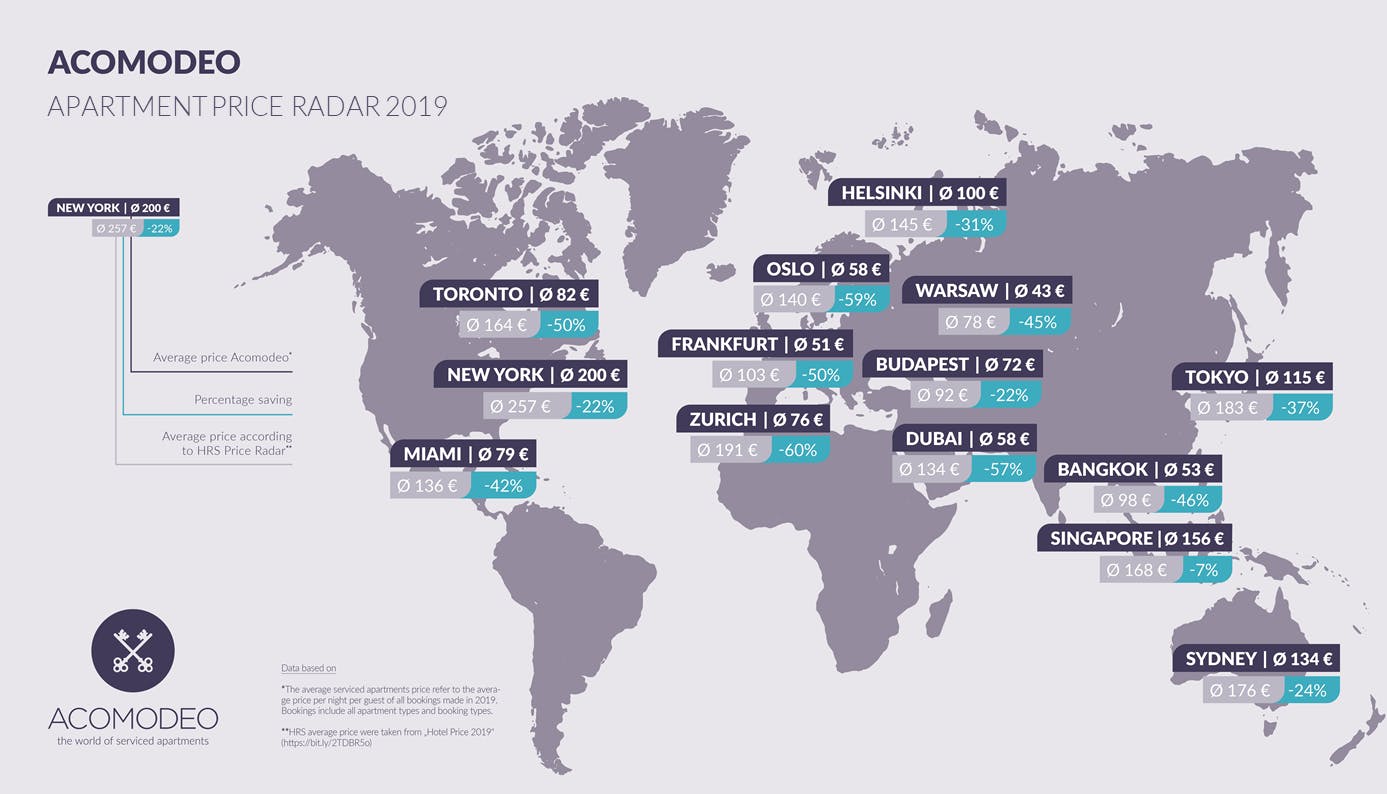

World

When considering the world’s major business destinations, a wide variety in terms of both pricing and savings potential is evident. Price gaps range from -7% for Singapore to -60% for Zurich.

Looking at the megacities New York, Tokyo, Singapore and Sydney, a trend of relatively high prices (>115€) and saving potential (<-37%) can be identified. This is an indicator of the city’s expensive and scarce available building areas, which leads to the service apartment offer being underdeveloped.

The European region represents the other side of the coin, with prices well below 100€ and savings between 45% and 60%, with the exceptions of Helsinki and Budapest.

About this report:

For the completion of this analysis, Acomodeo collected and scrutinized booking data from its client-portfolio, consisting of over 500 companies, including 5 blue-chip companies and over 20 other multinational corporations. Average booked rates were extracted from Acomodeo's inventory pool of over half a million serviced apartments and then compared to the average hotel prices from the hotel booking portal HRS for all major business destinations for the year 2019.

Download Report:Acomodeo_Price Radar 2019.pdf